Spreads – Everything You Need To Know

Are you ready to spread some knowledge about Spreads in forex? Did you see what just happened here?

Spreads in forex can be a bit confusing but don’t worry, it’s not rocket science. It is subtracting the bid price from the ask price, and that could either affect your profits or losses. The bid is the price that you’re willing to buy the currency whereas the ask is the price that you’re willing to sell the currency.

You’re a farmer selling wheat to a mill owner. They buy it from you for $200/ton and sell flour made from that wheat for $300/ton. The $100 difference is the spread, representing the mill owner’s profit margin.

Now, keep in mind that the difference between the bid price and ask price will depend on various brokers and the currency pairs that you’re trading. Major currency pairs tend to have tighter ones, while minor pairs tend to have wider ones.

Let’s simplify this to understand better.

Major currency pairs like EUR/USD tend to have tighter spreads because they’re more heavily traded with more than $2.3 trillion trading volume. Minor currency pairs like USD/PLN, on the other hand, may have wider spreads because they’re less commonly traded (their total trading volume is $51 billion only).

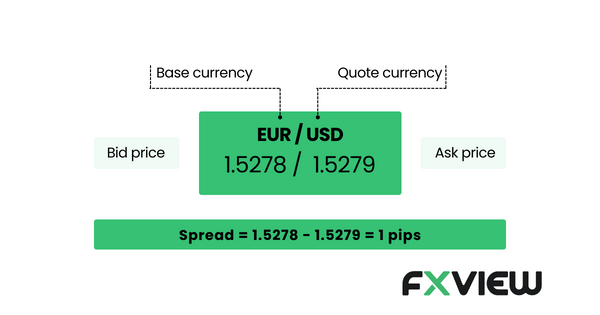

Calculating Spreads in Forex

Calculating the spread in Forex is as simple as a basic maths equation – subtract the bid price (the selling price) from the ask price (the buying price).

For example, if the bid price for the EUR/USD currency pair is 1.5278 and the ask price is 1.5279, the spread is 1 pip. Is it still confusing how it came to be 1 pip? Read more about how pips are calculated here. Pips refer to the smallest unit of measurement in forex trading and are usually equal to 0.0001 of a currency unit. In this example, the spread is 1 pip or 0.0001 of a currency unit.

Types of Spreads

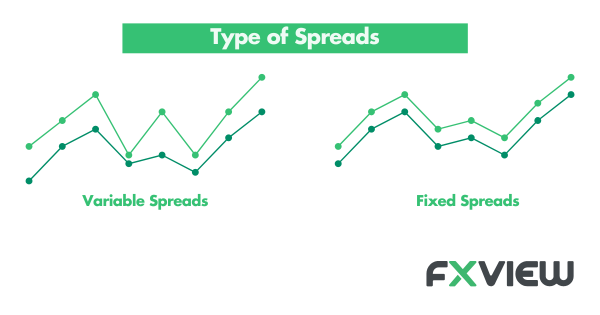

There are two main types: fixed and variable.

Fixed spreads are like Sheldon Cooper, if you know what we mean. They remain constant no matter what the market conditions are. They strictly adhere to their defined set of rules.

Then there are variable spreads, aka Penny Hofstadter, more like that spontaneous friend who’s always up for an adventure. They change according to the market conditions, which may potentially affect your profits (or losses).

Traders may prefer variable over fixed in Forex for their flexibility, transparency, and potential cost-effectiveness during low market volatility. So, whether you choose a fixed or a variable, it is important to choose a reputable broker that provides transparent and competitive spreads.

Pros and Cons of Spreads

An advantage is that they may offer you more options as a trader. By giving you a range of bids and ask prices to choose from, you can decide on the best entry and exit points for your trades. Hmm, sounds like a buffet of options to choose from, except instead of food, it’s money.

Now onto the dark side, with more options comes more confusion. The wide variety of spreads and currency pairs available can be overwhelming for new traders. It’s like trying to choose a pizza topping when the menu has 50 different options.

But don’t worry, with some research and practice, you may be able to understand better. You may look for brokers with the lowest spreads possible, and take the spread into consideration while assessing your risk management strategy.

Finally, don’t forget to keep an eye on market conditions that may potentially affect them. Just like checking the weather before going out, it’s important to keep up with news and events that can potentially widen spreads. This includes economic data releases, central bank announcements, and anything that can cause volatility in the market. That’s a lot to take in, but we are here to guide you all the way!

Key Takeaways

- Spreads in forex are the difference between the bid and ask price of a currency pair.

- Major currency pairs tend to have tighter spreads than exotic pairs which may have a wider.

- To calculate the spreads in forex, you have to subtract the bid price from the ask price.

- There are two primary types: fixed and variable.

- Factors like important news announcements or an event may cause them to change due to the higher market volatility

Conclusion

In simple terms, spreads in forex are like profit margins for traders. It’s the difference between what you pay to buy a currency and what you get when you sell it. The size of the spread depends on the currency pair and market conditions, spreads may not sound like an interesting topic, but it is quite important to learn if you want to enhance your trading skills. So, spread the word (pun intended), and happy trading!

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment or trading advice. You should not make any financial, investment or trading decision based on the information provided in this article without performing your own research or seeking advice from an independent advisor.