Mastering Pips and Lots: A Comprehensive Guide for Traders

If you’re new to forex trading, you must have come across the term “pip” and probably wondered what it means. So let’s talk about pips – those little guys that can make or break your trades.

Understanding Pips

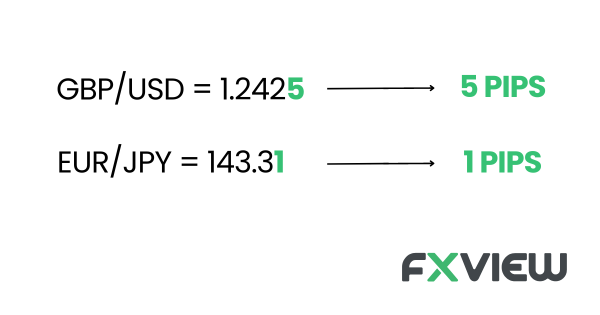

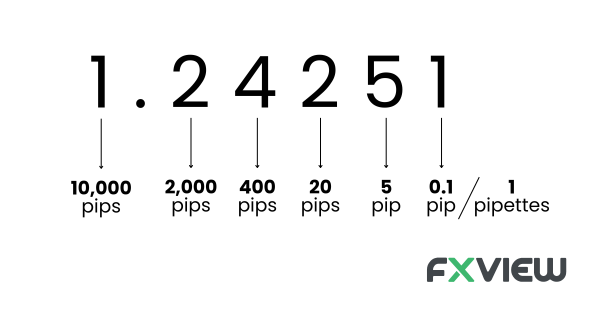

Well, they’re basically just units of measurement for currency pairs. When you see a price quote for a currency pair, it’s usually shown with four or five decimal places, right? So, the smallest movement in that price is called a pip, and it’s typically the last digit on the right.

Now, don’t let their tiny size fool you – pips can add up quickly, especially if you’re trading with high leverage, which is explained here. Assuming you are buying the GBP/USD at 1.2425 it moves up to 1.2525. That’s a hundredth-pip move, and if you’re trading with a standard lot size (100,000 units), that’s a hundred bucks in profit.

Of course, the opposite is also true – if the GBP/USD drops from 1.2425 to 1.2415, you’re down a hundred bucks! Ouch! You may now understand why it is crucial to focus on pips and comprehend how they might impact your trades.

So, there are also pipettes, what is that?

Oh wait, you thought pips were small? Wait till you meet their younger cousin, pipettes! They’re like little siblings who always want to tag along. Pipettes are just one-tenth of a pip, and you’ll usually see them when trading with some brokers. They might not be important, but still, they can make a difference in your trades. Despite looking small, they can add up quickly just like their bigger siblings, or the opposite if you underestimate those little guys.

Calculating the value of a Pip

In order to calculate the value of a pip, you need to know three things: the currency pair you’re trading, the size of your position, and the exchange rate. Here’s an example, so you don’t have to pull out your calculator and give yourself a headache.

Let’s say you’re trading the EUR against the USD with a standard lot size of 100,000 units. The exchange rate is 1.2425, and the value of one pip is 0.0001. To calculate the value of a pip, you would need to do the following formula:

A pip’s value = (0.0001 / exchange rate) x position size

In this case, the value of a pip would be:

A pip’s value = (0.0001 / 1.2425) x 100,000 = $8.04

This means that for every one-pip movement in the EUR/USD currency pair, your profit or loss would be $8.04.

Why Pips are important?

Pips are the backbone of forex trading. They represent the smallest unit of measurement for a currency pair‘s price movement, and they’re essential for calculating profit and loss. Think of pipettes as the GPS for your trades as they could give you precise directions and help you stay on the right track.

But that ain’t all! Keep in mind that pips are very important because they allow you to manage your risk efficiently and effectively. By knowing the pip value of a trade, you can set your stop-loss and take-profit levels with precision, which may help you avoid blowing up your account. Also, let’s be real, who wouldn’t love to see those pips adding up in their favor? There’s nothing quite like the feeling of closing a trade with a big pip gain and knowing you made a smart move.

Key Takeaways

- Pips are units of measurement for currency pairs, and they represent the smallest movement in the price of currency pairs.

- Pip’s full form is ‘Percentage in Point’ or ‘Price Interest Point’ and they can add up quickly and affect your profits and losses.

- You will need to know the currency pair, position size, and exchange rate, in order to calculate the value of a pip.

Conclusion

So, that’s a brief (and hopefully amusing) explanation of what pips are in Forex and how they work. Pips might look small, but they leave a huge impact on your trading results. So guess what? Keep an eye on it, use proper risk management, and do not underestimate the power of those pesky little critters.

Happy Trading!

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment or trading advice. You should not make any financial, investment or trading decision based on the information provided in this article without performing your own research or seeking advice from an independent advisor.

Can I ask you to clarify some things? Could you show an additional example? Thank you!

Thank you for the auspicious writeup. It in fact was a amusement account it. Look advanced to far added agreeable from you! However, how can we communicate?