Top Traded Currencies in the World

As the global economy continues to grow and expand, more and more currencies are being traded on the foreign exchange market. The foreign exchange market is the largest and most liquid financial market in the world, with an average daily trading volume of over $7 trillion. Now, are you curious about the top traded currencies in the world? Well, let’s delve into the exciting world of forex trading!

Top Traded Currencies in the World

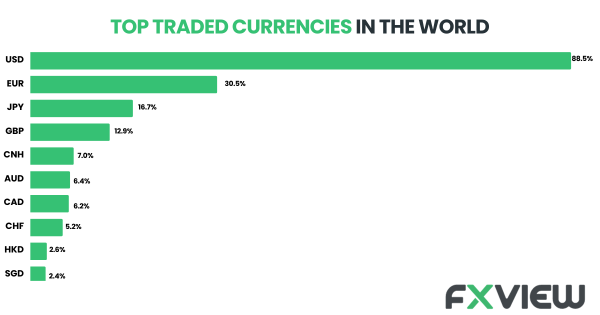

1. United States Dollar (USD)

That’s right, the good old greenback is still holding strong as the most traded currency in the world, accounting for over 88% of all forex trading volume. The US dollar is the primary reserve currency used by central banks around the world, making it one of the top traded currencies for international trade. It is often used as a benchmark for other currencies, and its movements can have a significant impact on the forex market. Thus, is the top traded currencies.

2. Euro (EUR)

The Euro has also made its mark on our list of Top Traded Currencies in the world because it accounts for around 30% of forex trading volume. The Euro is the official currency of the European Union and is used by 19 member states. The euro’s popularity is due to the size and strength of the European economy, as well as its widespread use in international trade.

3. Japanese Yen (JPY)

The Japanese Yen is the third most traded currency in the world, accounting for around 16% of forex trading volume. The Yen is the official currency of Japan and is known for its stability and low inflation rate. The Japanese Yen may not be the most exciting currency out there, but it could be worth paying attention to it.

4. British Pound (GBP)

The British pound is the fourth most traded currency in the world, representing around 12% of all forex transactions. The value of the Pound can be influenced by a range of factors, including economic data, political events, and interest rates.

5. Chinese Renminbi (CNH)

The Chinese Renminbi is the fifth most traded currency in the world, representing around 7% of all forex transactions. The Chinese Yuan, or Renminbi, can be influenced by a variety of factors, including the performance of the Chinese economy, interest rates set by the People’s Bank of China (the country’s central bank), and global market trends.

6. Australian Dollar (AUD)

The Australian Dollar is the sixth most traded currency in the world, representing around 6% of all forex transactions. The Australian economy is heavily reliant on exports, particularly to China, making the value of the Australian Dollar closely tied to global economic trends. The AUD can also be often used as a proxy for the Chinese Yuan due to the close economic ties between Australia and China.

7. Canadian Dollar (CAD)

The Canadian Dollar is the seventh most traded currency in the world, representing around 6% of all forex transactions. The Canadian Dollar is closely tied to the US Dollar due to the close economic ties between Canada and the United States. The Canadian economy is heavily reliant on natural resources, such as oil and gas, making the value of the Canadian Dollar closely tied to global commodity prices.

8. Swiss Franc (CHF)

The Swiss Franc is the eighth most traded currency in the world, representing around 5% of all forex transactions. The Swiss Franc can be known for its stability and may often be used as a safe-haven currency during times of economic uncertainty. The Swiss economy is heavily reliant on the financial sector, making the value of the Swiss Franc closely tied to global financial trends.

9. Hong Kong Dollar (HKD)

Despite being a small region, Hong Kong is a financial powerhouse, with a bustling stock exchange and a reputation for innovation in the finance industry. Hong Kong Dollar is the ninth most traded currency in the world, representing around 3.2% of all forex transactions. The Hong Kong Dollar can be influenced by a variety of factors, including the performance of the Hong Kong economy, interest rates set by the Hong Kong Monetary Authority (the territory’s central bank), and global market trends. In addition, the Hong Kong Dollar is pegged to the US dollar within a narrow trading band, which means that its value is closely linked to that of the US Dollar.

10. Singapore Dollar (SGD)

This little lion city’s currency has made its mark alongside major players in the financial world. Singapore Dollar is the tenth most traded currency in the world, representing around 2.6% of all forex transactions. With Singapore’s strong economy, stable government, and thriving financial sector, the Singapore Dollar has gained popularity among traders and that’s why it is in the list of top traded currencies. So, next time you see the SGD in action, remember that this currency may be small but it means serious business in the forex market.

Conclusion

The forex market is the largest and most liquid financial market in the world, with trillions of dollars being exchanged daily. It is important to note that the forex market is highly volatile, and currency prices can fluctuate rapidly in response to global economic and political events. Traders and investors need to stay informed about these events and have a solid understanding of the factors that influence currency prices to make informed decisions.

Hope, this comprehensive guide on top traded currencies helped you gain the knowledge.

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment or trading advice. You should not make any financial, investment or trading decision based on the information provided in this article without performing your own research or seeking advice from an independent advisor.