9 Must-Know Harmonic Patterns in Forex

In the world of forex trading, mastering prediction is crucial. Traders strive to indicate market movements accurately, seeking every advantage. Harmonic patterns, where mathematics meets psychology, provide a fascinating toolset. In this blog, we’ll explore some of the top harmonic patterns in forex trading, their importance, potential benefits and drawbacks, and how you may start planning your harmonic trading journey.

But why do Patterns form?

Patterns in financial markets form due to the collective behavior of traders and investors. These patterns are a result of human psychology and market dynamics. Traders often exhibit similar reactions to certain price levels, creating repetitive patterns that technical analysts use to make indications.

What Are the Harmonic Patterns in forex trading?

Harmonic pattern trading is a distinct price pattern that forms on a chart and is believed to indicate future price movements. These patterns are derived from Fibonacci retracement and extension levels and can be used by traders to make informed trading decisions.

Examples of Harmonic Patterns

Harmonic patterns in trading include the ABCD pattern, Gartley pattern, Butterfly pattern, and many others. These patterns are formed by specific price movements and Fibonacci ratios, which traders may use to indicate potential entry and exit points.

9 Harmonic Patterns good for traders to understand

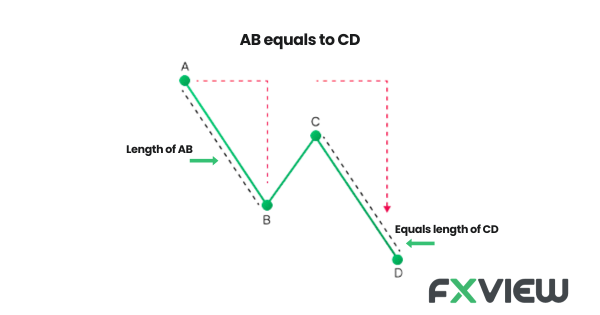

The ABCD Pattern: This foundational pattern consists of two legs, AB and CD. Traders can use it to identify potential reversals or continuations in the market. When AB equals CD, it can indicate balance and a potential reversal.

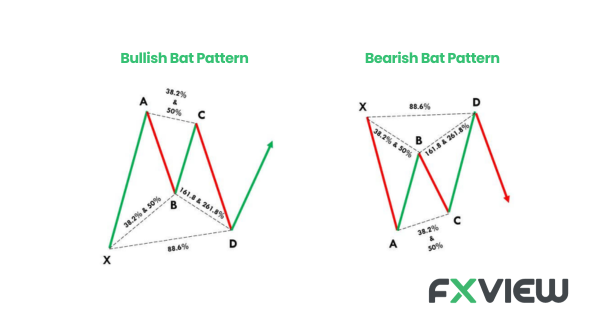

The BAT Pattern: BAT patterns resemble the “M” or “W” shapes on price charts. They may act as indicators for potential trend shifts, offering entry and exit points for traders looking to potentially capitalize on changing market directions.

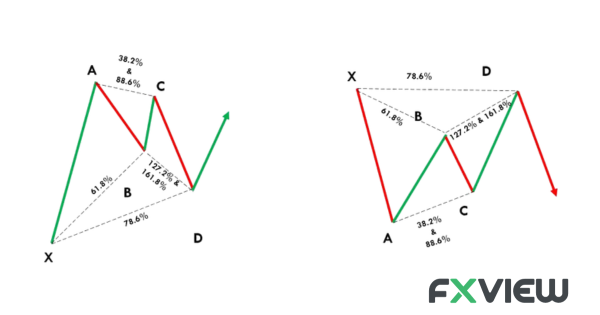

The Gartley Pattern: Known for its distinctive shapes, the Gartley pattern can indicate potential turning points in the market. Traders can use it as a tool to indicate potential opportunities to enter or exit positions.

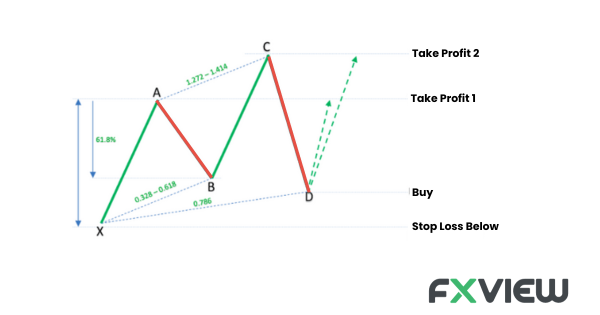

The Butterfly Pattern: Similar to the Gartley pattern, the Butterfly pattern forms an “M” shape on price charts, indicating potential reversals. Traders who can identify this pattern may gain potential insights into market reversals.

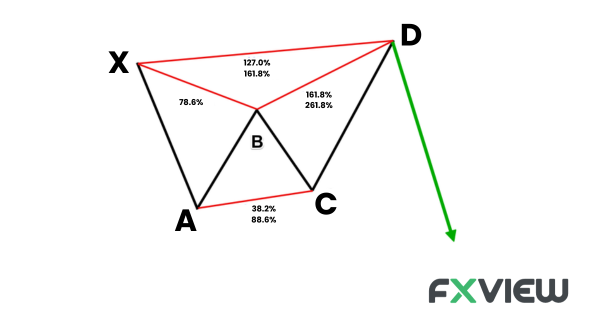

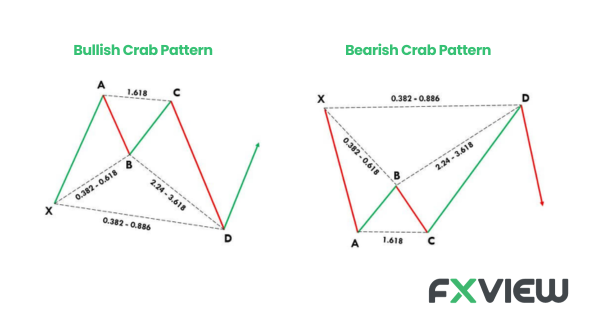

The Crab Pattern: With its unique appearance, the Crab pattern can act as a compass for traders to identify potential trend shifts. This pattern may help traders stay ahead by identifying moments when the market may potentially change direction.

The Deep Crab Pattern: As a variation of the crab pattern, the Deep Crab pattern is even more pronounced in its price movements. It can provide traders with a refined perspective on potential reversals, allowing for a deeper understanding of market dynamics.

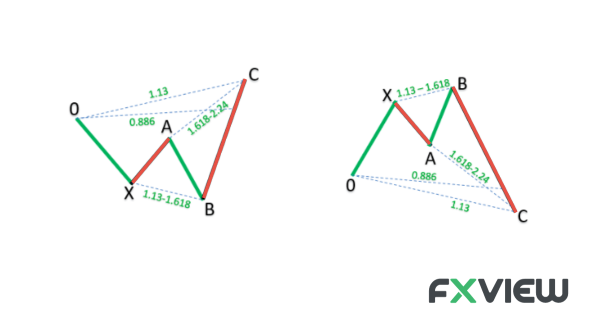

The Shark Pattern: Recognized by its sharp, V-shaped reversal, the Shark pattern can offer insights into potential price retracements. Traders may use this pattern as a tool, to assist them when making informed decisions about when and where to enter or exit trades.

The Cypher Pattern: A complex harmonic pattern, the Cypher pattern relies on precise Fibonacci ratios. It may be used to identify potential turning points in the market. Traders who understand this pattern can indicate potential key market shifts.

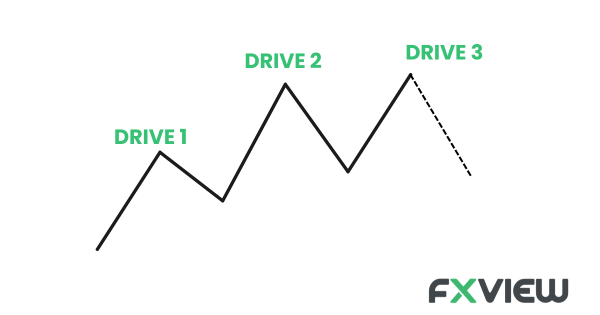

The Three-Drive Pattern: Comprising three distinct legs, the Three-Drive pattern can aid traders in indicating potential reversal zones. This pattern adds depth to trading strategies, potentially helping traders when making informed decisions.

These harmonic patterns can provide traders with helpful tools for technical analysis and decision-making in the dynamic forex market. Each pattern has its unique characteristics, and traders often combine them with other analysis techniques to enhance their trading strategy.

Understanding Harmonic Patterns

Harmonic patterns in forex trading are unique price patterns believed to indicate future price movements. Derived from Fibonacci retracement and extension levels, they can assist traders when constructing their strategy and making informed decisions, improving entry and exit points assessment.

Why are Harmonic Trading Patterns popular in forex trading?

Harmonic patterns have gained popularity in forex trading due to their systematic approach to price analysis. They provide a structured framework that may aid traders in enhancing their trading strategy and trading confidence.

How to start planning your trading strategy with Harmonic Patterns

Start Planning your harmonic trading journey by:

- Learn Harmonic Patterns: You may start by thoroughly understanding various harmonic patterns. Study their characteristics, including how they form and what they signify on price charts. This foundational knowledge is essential for pattern recognition.

- Recognize Patterns on Charts: You may consider practicing recognizing harmonic patterns on real price charts. Look for the specific shapes and alignments that indicate the presence of these patterns. It’s crucial to be able to identify them.

- Utilize Fibonacci Tools: Harmonic patterns may often rely on Fibonacci retracement and extension levels to indicate their authenticity. Familiarize yourself with these technical tools and how they are applied in harmonic pattern analysis.

- Pattern Validation: When you identify a potential harmonic pattern, you may use Fibonacci ratios and other technical indicators to indicate its authenticity.

- Develop a Trading Strategy: Create a comprehensive trading strategy that incorporates harmonic patterns. Determine how you may use these patterns when constructing your trading strategy, including entry and exit points. Additionally, integrate risk management techniques to protect your capital.

- Demo Account Practice: Before venturing into live trading, it would be helpful to practice your harmonic pattern recognition and trading strategy on a demo account. This allows you to refine your skills without risking real capital. It’s an essential step to build confidence and competence.

- Continuous Learning: Harmonic trading is an ongoing learning process. Stay updated with market trends, new patterns, and evolving strategies. Continuously refine your approach based on your trading experiences.

By following these steps, you can start planning your harmonic trading journey with a solid foundation. Remember that understanding harmonic patterns takes time and practice, so remain committed to learning and improving your skills.

Advantages of harmonic patterns in forex trading

- Structured and Systematic Signals: Harmonic patterns can provide traders with a structured framework that can potentially assist when making their trading decisions. They can offer entry and exit points, creating a systematic approach to trading.

- Indication of Reversals and Continuations: Harmonic patterns may excel in helping traders indicate potential reversal points where trends may potentially change direction or continue. This insight might be important for timing trades.

- Enhance your strategy with Other Analysis Methods: Harmonic patterns can be used in conjunction with other technical analysis methods, such as support and resistance levels or trend analysis. Combining these techniques with harmonic patterns can enhance trading strategy.

Disadvantages in harmonic patterns in forex trading

- Not Infallible: Harmonic patterns are not foolproof indicators. There are instances when these patterns may fail to accurately predict price movements. Traders should be aware that no analysis method is infallible in order not to solely rely on them when making their trading decisions.

- Proficiency and Practice Required: Effectively identifying and applying harmonic patterns requires skill and practice. Novice traders may struggle with pattern recognition and interpretation, emphasizing the need for education and experience.

- Overtrading Risk: Overreliance on harmonic patterns without proper risk management can lead to overtrading. Traders may be tempted to enter multiple positions solely based on patterns, which can expose them to higher risks.

Understanding the advantages and disadvantages of harmonic patterns is essential for traders. While they may offer valuable insights and structure to trading strategies, they should always be part of a comprehensive trading strategy that includes risk management and ongoing learning.

Key Takeaways

- Harmonic patterns seem to be powerful tools in forex trading, derived from price formations and Fibonacci levels, used for indicating potential future price movements.

- These patterns arise from the collective behavior of traders and investors, influenced by human psychology and market dynamics.

- Nine essential harmonic patterns include the ABCD pattern, BAT pattern, Gartley pattern, Butterfly pattern, Crab pattern, Deep Crab pattern, Shark pattern, Cypher pattern, and Three-Drive pattern.

- Identification of these patterns on price charts might be fundamental to harmonic trading.

- Fibonacci retracement and extension levels can serve as critical tools for indicating the authenticity of harmonic patterns.

- Developing a comprehensive trading strategy that integrates harmonic patterns and risk management techniques is essential for the construction of a trading strategy.

- Practicing on demo accounts can help traders refine their skills and build confidence before trading with real capital.

- Continuous learning and staying updated with market trends are vital for harmonic trading.

- Harmonic patterns offer structured and systematic indications that may assist traders when making well-informed trading decisions.

- While powerful, harmonic patterns are not infallible, and traders should exercise skill and caution, pairing them with proper risk management.

- Understanding harmonic patterns can potentially enhance a trader’s ability to navigate the complex world of forex trading with more confidence.

Conclusion

Harmonic patterns in forex trading can provide a structured approach to analyzing price movements, offering indicative tools that might be helpful for traders in their decision-making process. They are not infallible and traders should not solely rely on them when making trading decisions, however with a proper risk management approach and deep market knowledge, they can be helpful tools when constructing trading strategies. By understanding and embracing harmonic patterns, traders’ ability to navigate forex trading with more confidence, might be enhanced.

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment, or trading advice. You should not make any financial, investment, or trading decisions based on the information provided in this article without performing your own research or seeking advice from an independent advisor.