Understand the Currency Pairs: Bid and Ask Rate

Imagine a bustling market where two vendors engage in a lively price negotiation – that’s essentially what happens in the forex world with bid and ask rates.

Let’s simplify the concept of currency pairs, unravel the mystery behind the bid and ask rates, and equip you with the knowledge to navigate the forex market like a pro. So, get ready for a quick journey into the world of forex trading!

What is a Currency Pair?

A currency pair is like a dance in forex trading, where two currencies move together on the trading floor.

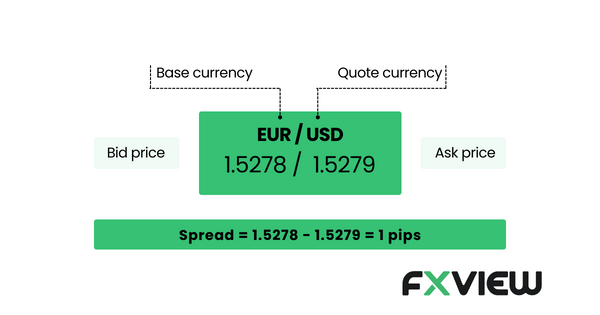

These pairs are represented by three-letter codes, and they tell us how one currency struts its stuff in comparison to the other. For instance, in the EUR/USD pair, the Euro (EUR) is like the star performer, and the US Dollar (USD) is the audience watching and judging the performance.

So, currency pairs are basically the choreography of the forex world, and understanding their routines is your ticket to mastering the dance of trading in the global currency market!

What is Bid rate?

The bid rate is like the “bargain buddy” of the currency pair. It is the price at which a trader is ready to buy the base currency, and it’s always on the lookout for a good deal. It is the starting point for a trade, and traders look for bid rates that are favorable to their buying strategy.

What is the Ask rate?

On the other hand, the ask rate is like the “confident companion” of the currency pair. It’s the price at which a trader is willing to sell the base currency. It’s the selling point for a trade, and traders look for ask rates that are favorable to their selling strategy.

How does spread relate to bid and ask rate?

The difference between the bid and ask is known as the “spread“, and that’s what makes the business in the forex market. It’s like a fee you pay for the convenience of buying or selling a currency pair. Traders should keep in mind that the spread affects the overall trading costs, and it’s an important factor to consider when entering or exiting a trade. However, you should always bear in mind that there may be other costs that may have an impact on the results of the trade. Therefore, you need to ensure that you are familiar with all the applicable costs and charges to be able to make informed decisions based on your risk assessment and trading strategy.

Key Takeaways

- Bid rate: It is the price at which a trader is ready to buy the base currency.

- Ask rate: It is the price at which a trader is willing to sell the base currency.

- Spread: It is known as the difference between the bid price and ask price of a currency.

- Trading Costs: Traders should be aware that spreads can impact overall trading costs, but it’s essential to consider other associated costs and charges when making trading decisions.

Understanding these concepts is vital for navigating the forex market effectively and making informed trading choices.

Conclusion

Bid and ask rates are the dynamic duo of the forex market, constantly interacting and influencing each other. Understanding their roles and how they affect your trading decisions is crucial in forex trading. So, embrace the friendly tone of bid and ask rates, and get ready to start your forex trading journey being equipped with the information you need.

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment or trading advice. You should not make any financial, investment or trading decision based on the information provided in this article without performing your own research or seeking advice from an independent advisor.