Blogs

- All

- Strategies & Tools

- Beyond Forex

- Market Analysis

- Trading Basics

- Risk Management

- Harmonic Trading Patterns

4 Mins Read | Nov 5th 2024

US Election 2024: Effect of Presidential Elections on the Market

U.S. presidential elections is a thrilling turning point for the global markets, often triggering a dramatic shifts in the financial markets. The policies of the newly elected president can reshape the entire economic sectors and trigger changes in market sentiment.

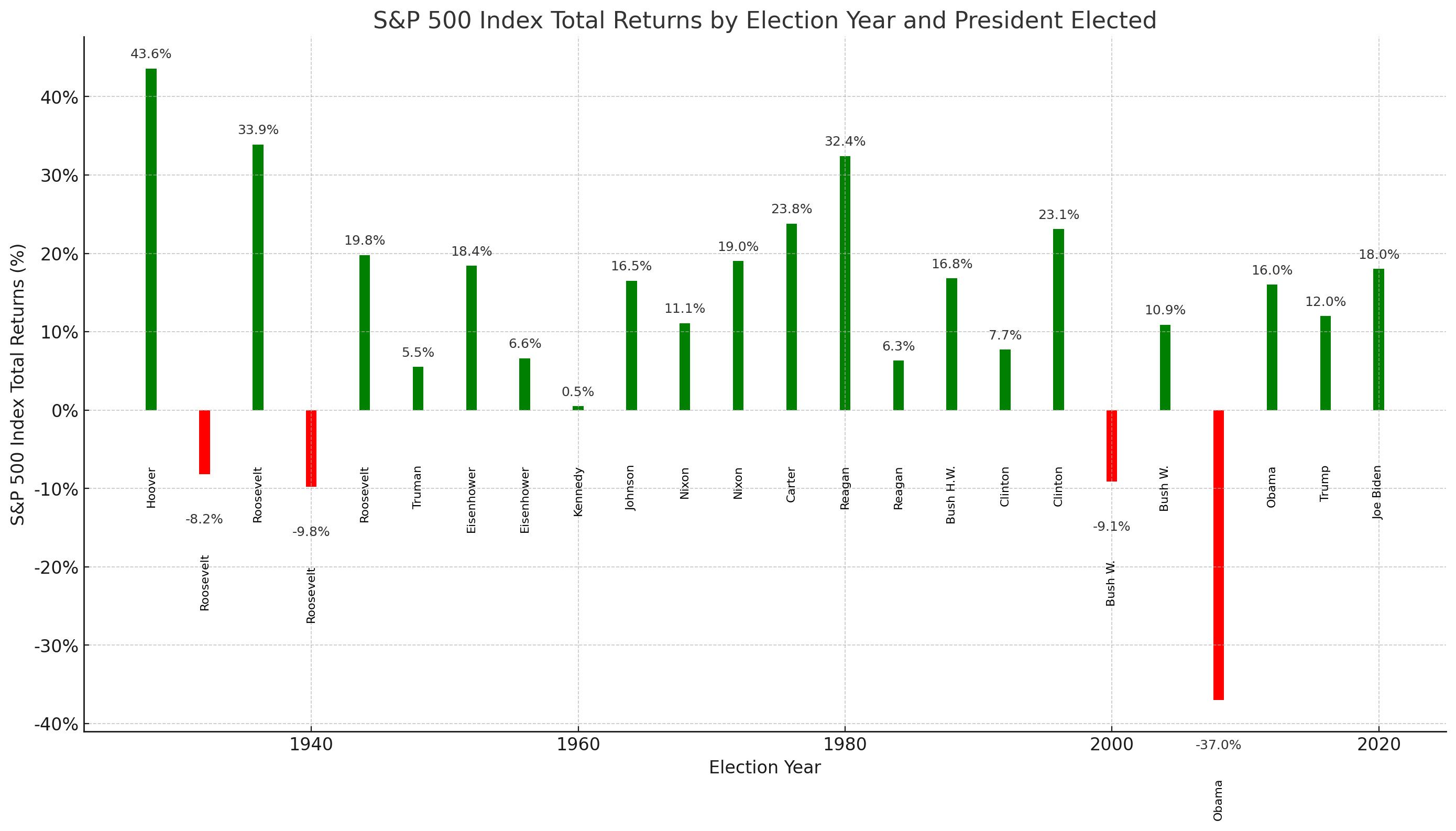

While numerous factors affect the stock market performance, a notable trend is the correlation between U.S. presidential elections results and S&P 500 movement. Historically, the stock market often saw a positive return after the U.S. presidential elections, especially when there has been a change in the administration.

Trends to Watch in the Historic U.S. Presidential Elections

Since the inception of S&P 500, there have been twenty four U.S. presidential elections, with twenty of them yielding positive returns. When a Democrat was in power and another Democrat took office, the average yearly return was 11%. However, when a Democrat was in power and a Republican was chosen, the average return rose to 12.9%

Trump Trade

Donald Trump, the Republican Party’s current candidate, is in the favour of deregulation and tax reduction. The Trump administration’s emphasis on fossil fuels, easing of environmental regulations, gloom about climate change, and elevated hopes for economic growth—particularly in the banking, oil, and defence sectors—may have an impact on the expansion of the renewable energy sector. This was demonstrated in 2016 when hopes of an expansionary fiscal policy caused the stock markets to rebound swiftly following Trump’s victory.

Thus, Trump’s ideas would probably centre on raising tariffs and government spending if he wins the U.S. presidential elections. Treasury bonds and foreign exchange markets may be impacted by this increase in inflation. Additionally, stock prices may also rise as a result, particularly for American firms that are linked to economic expansion. Trump may even consider eliminating the income tax entirely and provide all of the government’s funding solely through tariffs or by enacting further tax breaks.

What if Harris wins U.S. Presidential Elections?

On the other hand, Democrats, represented this time led by Kamala Harris, have advocated for progressive fiscal policies, emphasising the need for increased public spending as well as potential tax hikes for corporations and high-income earners. Kamala is in favour of measures to boost renewable energy, such as aggressive climate targets and investments in sustainable technology. Harris is therefore seen as being better suited to promoting renewable energy projects.

Therefore, if Harris wins the U.S. presidential elections, she is likely to focus on reversing Trump’s acts.Increased taxes may have an effect on business earnings, and rather than significant policy changes, the dynamics of the economy as a whole would take precedence.

Scenarios

• Republican Clean Sweep: Yields would probably rise, which would benefit industries such as finance, energy and cryptocurrency.

• Divided Congress: Some of Trump’s promises, such as tax cuts and tariffs, would still be implemented on a smaller scale, if he wins but Congress is divided. There probably won’t be any significant policy changes if Harris wins with a divided Congress, and markets may experience a short-term surge if Trump’s policies and tariffs are rolled back.

• Democrats Clean Sweep: The stock market might suffer from more progressive changes, probably more regulations, and greater taxes.

Conclusion

In the end, a change in administration can have a profoundly impact on many economic sectors and drive significant shifts in the stock market, presenting both challenges and opportunities for investors.

Disclaimer: The information contained in this article is provided for educational and informational purposes only and it is not intended to be, nor does it constitute financial, investment, or trading advice. You should not make any financial, investment or trading decisions based on the information provided in this article without performing your own research or seeking advice from an independent advisor.