Blogs

- All

4 Mins Read | Jun 6th 2025

Non-Farm Payrolls: What Traders Need To Know Ahead of June 2025 Release

Introduction

The U.S. Non-Farm Payrolls (NFP) report is one of the most closely watched economic indicators worldwide. Set to be released on Friday, June 6, 2025, at 12:30 PM GMT, it offers a fresh look at the U.S. labor market, covering about 80% of the workforce. In this article, we’ll break down what makes the NFP so important, what the markets are expecting this time around, and most importantly, how traders can use this info to make smarter moves when the data drops.

But before we dive into all that, it’s worth taking a moment to understand exactly what the Non-Farm Payrolls report measures, and why it’s so important for traders.

Key Components of the NFP Report

The NFP release includes several vital statistics that together paint a broader picture of the labor market:

- Jobs Added (Headline Payroll Number): The net number of jobs added or lost, excluding farming and certain other categories. This figure reflects overall employment health.

- Unemployment Rate: The unemployment rate shows the proportion of working people who seek employment but cannot secure jobs. A low unemployment rate typically indicates a strong job market.

- Average Hourly Earnings: The average hourly earnings indicator shows wage inflation through its measurement of overall worker compensation. The increase in wages leads to inflation, which serves as a key factor for central bank policy decisions.

- Labor Force Participation Rate: The labor force participation rate shows the percentage of people who work or seek employment. The changes in this workforce participation rate indicate shifts in how people engage with work.

- Sectoral Employment Trends: The job market expansion or contraction becomes visible through sector-specific data, which tracks healthcare, manufacturing, government, and transportation industries.

The complete understanding of these components enables proper analysis of the economic implications presented in the report.

Critical Economic Trends Impacting the Next NFP Data

As traders anticipate the upcoming NFP report, several key factors are shaping market expectations.

- Trade policies: Recent tariff policies, particularly those involving China, have added to market uncertainty, potentially impacting hiring, especially in trade-sensitive sectors.

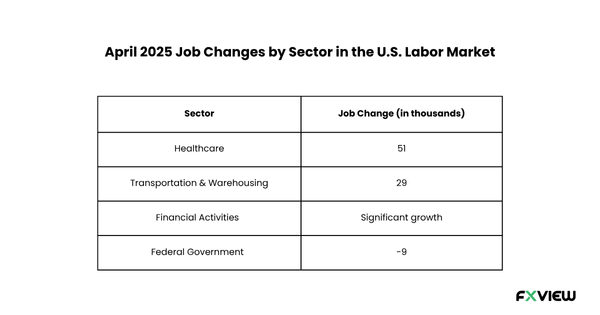

- Sectoral shifts: In April, manufacturing employment was flat (-1,000) in April, with a loss of 82,000 jobs over the past year. Retail trade employment changed little (-2,000), with a slight increase of 73,000 jobs over the past 6 months. While both these sectors may experience slower job growth or contractions, expansions in healthcare and transportation are expected to offset these declines.

In April 2025, notable job gains were recorded in:

Data Source: Bureau of Labor Statistics

- Federal Reserve’s outlook: The NFP data is a crucial input in shaping monetary easing expectations. Weak job growth or rising unemployment could increase the likelihood of monetary easing.

Given the current economic uncertainties, the Fed is likely to maintain its stance while closely monitoring NFP data as an indicator for future policy adjustments.

Source: Reuters

Understanding these interrelated factors helps traders better interpret the NFP data and anticipate potential market reactions.

Upcoming NFP Data: What to Expect on June 6, 2025

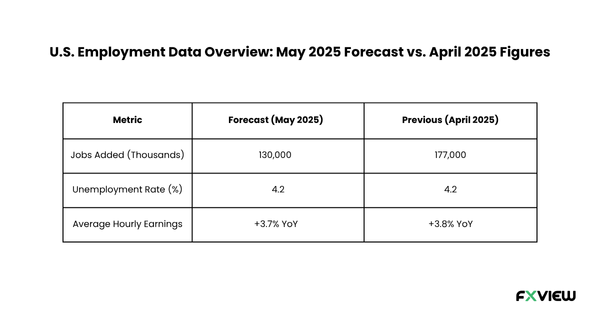

Market forecasts anticipate that the May 2025 NFP data, to be released on June 6, will show the addition of approximately 130,000 jobs, a moderation from April’s 177,000 increase. The unemployment rate is expected to remain stable at 4.2%.

The following table summarizes recent employment data:

Data source: Investing.com

How Does NFP Affect Markets?

The release of NFP figures often leads to increased market volatility, particularly in:

- FX Market Impact: USD currency pairs, including EUR/USD and USD/JPY, tend to experience significant price fluctuations. Stronger employment data typically strengthens the dollar by reinforcing expectations of monetary tightening.

- Stocks and Indices: Robust job growth can support equity prices, although concerns about wage-driven inflation may temper enthusiasm.

- Gold & Inflation-Sensitive Assets: Gold prices often react inversely to the dollar and shifts in rate expectations following the NFP release.

Traders should therefore anticipate rapid price movements and adjust risk management strategies accordingly.

What Traders Should Watch and Consider

For traders, the Non-Farm Payrolls report is more than just numbers - it’s a catalyst for market movement and an insight tool for potential shifts in economic policy.

- Compare Actual vs. Forecasted Job Numbers: If the headline number significantly beats or misses market consensus, expect sharp moves in USD pairs and equity indices. Surprises tend to lead to heightened volatility.

- Monitor the Unemployment Rate: A falling or stable unemployment rate, coupled with strong job growth, signals a tightening labor market. This can influence market expectations, potentially lowering the likelihood of further easing or a dovish stance from the Fed. Conversely, weak job growth may heighten expectations for continued accommodative policies from the Fed.

- Watch Wage Growth: Rising average hourly earnings can signal inflationary pressure. If wages increase faster than expected, traders may anticipate the Fed adopting a more hawkish stance, affecting interest rate-sensitive assets.

- Expect High Volatility During the Release Window: Because NFP releases cause rapid price swings, employing risk management techniques such as setting stop losses, limiting position sizes, or using options strategies can help mitigate potential losses.

Understanding these factors and watching for deviations from expectations can help traders position themselves more effectively before and after the data release.

Conclusion: Be Ready to Trade NFP with Fxview

The upcoming Nonfarm Payrolls report will be a pivotal indicator for gauging U.S. economic strength and Federal Reserve policy direction. Traders should prepare not only for the data release itself but also for the heightened volatility that often follows.

With market movements intensifying around such key events, having access to reliable tools and a user-friendly trading platform becomes essential. Fxview provides a robust trading environment with lightning-fast execution, real-time market data, and advanced analytics - ideal for navigating high-impact releases like the NFP.

Stay informed, manage your risks wisely, and leverage the insights from the NFP report to make well-informed trading decisions.

Disclaimer: This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. Fxview makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

Related Posts

View AllRelated Posts

Feb 12th 2025

What is Gartley Pattern?

Feb 12th 2025

Fundamental Analysis

Feb 12th 2025

How to use the Crab Chart Pattern in Trading?

Feb 12th 2025

Start Forex Trading: 8 Essential Steps

Feb 12th 2025

9 Popular Economic Indicators in Forex

Feb 12th 2025

Market Sentiment Indicators- An Ultimate Guide!

Feb 12th 2025

What is Sentiment Analysis in Forex Trading?

Feb 12th 2025

9 Must-Know Harmonic Patterns in Forex

Mar 13th 2025

Is The Ukraine Conflict Affecting CFDs and Markets?

May 20th 2025

Will the RBA Cut Rates by 25 Bps on May 20?

May 20th 2025

Will the RBA Cut Rates by 25 Bps on May 20?

Ready to trade?

Open an account in less than 5 minutes. Start trading your way.